In cases where complete lack of working capability is determined, it is possible to receive disability pension up until the age required to realize the right to old age pension if:

- the reason for disability is injury at work or professional disease, regardless of the length of pensionable service;

- the disability is a consequence of disease or injury unrelated to work, in which case at least five years of pensionable service are required.

These conditions do not apply to people who became disabled before age 30:

- for individuals aged 20, at least one year of pensionable service is required;

- for individuals aged 25, at least two years of pensionable service are required;

- for individuals aged 30, at least three years of pensionable service are required.

Regulations stipulate that a follow-up examination must be performed within three years, with the exception of individuals aged above 58 and those whose diagnoses are such that they are not likely to experience working capability improvement. Request for follow-up is sent ex officio, accompanied by the invitation and information on required documentation. If an individual does not respond to the invitation or misses the appointment without justification, pension payment shall be suspended.

IMPORTANT NOTES

- If the insurant receives unemployment benefits, the request is submitted with expert assistance of the National Employment Office.

- If you worked abroad, including the former Yugoslav republics, the right to that part of pension will be determined in accordance with the respective country regulations.

- If you have confirmed pensionable service in former Yugoslav republics, you should file a certificate or registered data listing.

- If you are employed at the time of becoming a disability pension user, your employer is obliged to pay you severance amounting to at least two average salaries (Article 119 of Labor Law).

- You do not need to be employed when submitting the request.

- Only the service years with paid contributions are recognized.

- The procedure is initiated while you are an insurant. The decision on the amount of disability pension is issued only after disability has been confirmed and the corresponding decision issued.

- The retiree should report each address change to the Fund.

- A disabled retiree can acquire insurance based on service contract or author contract, but not based on work contract. Upon signing a work contract, the retiree’s pension payments shall be suspended and he/she will be invited to a follow-up examination.

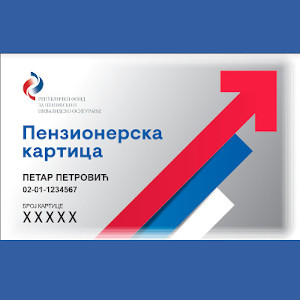

- You can receive pension to your bank account, to your home address (for home address payments, the amount will be reduced by the amount of postal expenses), at the delivery post office counter (without payment-related costs), to the account of the institution where the user resides, to a foreign currency account (for users whose place of residence is outside the territory of the Republic of Serbia) and through authorized persons (authorization is valid for one year and it is renewable).

- Beneficiaries of disability category II or III who had exercised this right before the Law on Pension and Disability Insurance came into force in April 2003 and who lose the status of insured person regardless of their will and without their fault (redundancy, bankruptcy or company closing etc.), shall receive disability pension in the amount of 50% of disability pension (after they stop receiving benefits from the National Employment Office). To exercise the right, a person should submit an application to the appropriate branch of the Pension and Disability Insurance Fund using the approved form and enclosing the documents indicated on the application form. If the beneficiary of this right becomes employed, the payments shall be terminated.